Even in the best economic circumstances, loans are often a necessity, especially for critical purchases like homes and cars.

For some insight into the lending landscape, Mastercard surveyed 7,600 consumers across the United States, Canada, the United Kingdom, Australia, France, Germany and Spain about their recent financial experiences.

The upshot: 89% have been adversely affected by economic pressures, and nearly half are struggling to get the loans and credit they need.

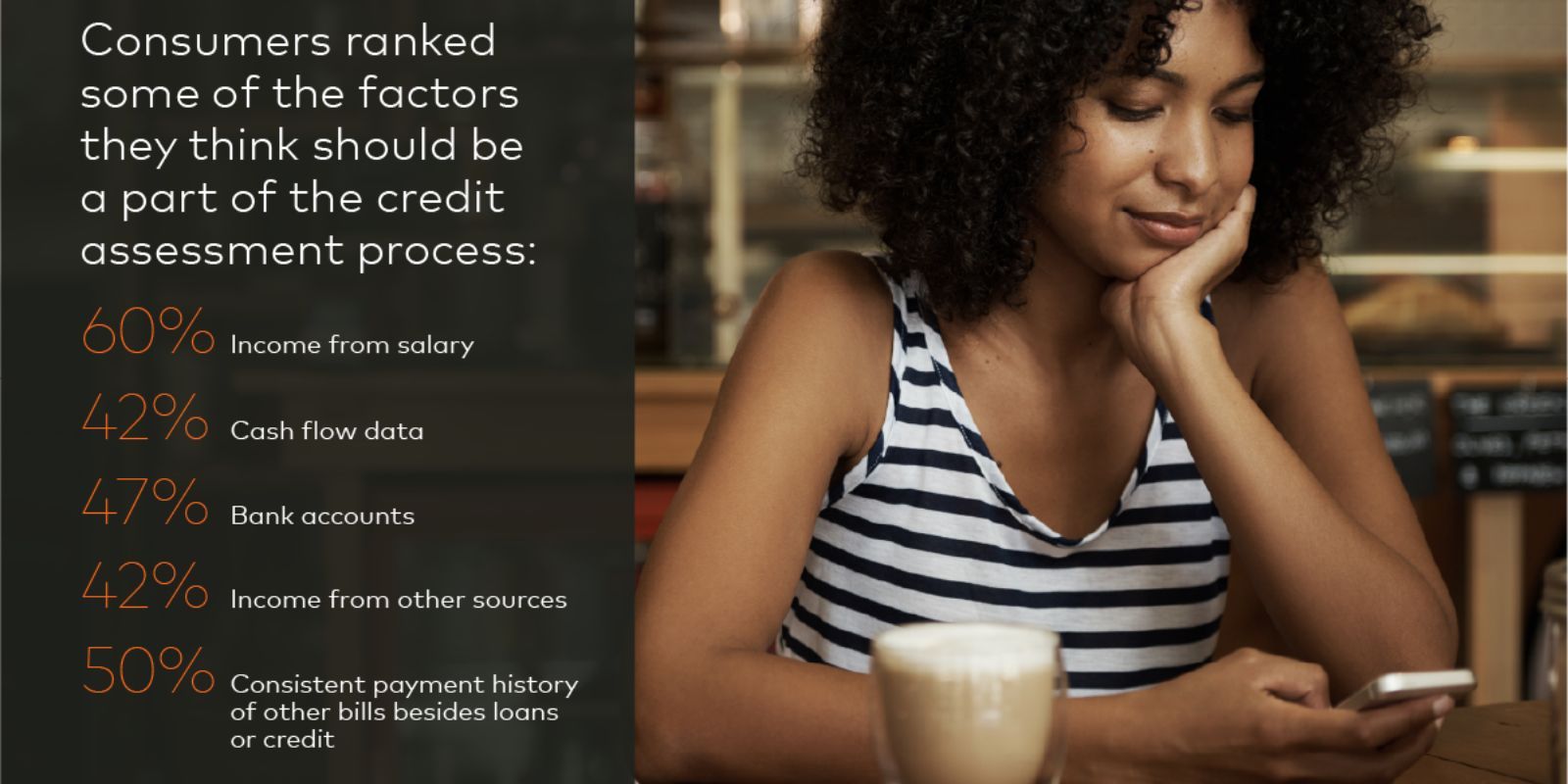

Traditional credit scores do not always reflect an applicant’s ability to make payments. Individuals with thin or no credit history can struggle to qualify for credit. Young adults on their own for the first time, gig workers who deal mostly in cash, new Americans and retirees with a single credit card and no loans can struggle to qualify for leases, credit cards and mobile phone contracts.

Survey says: Consumers want transparency in lending decisions

To most consumers, change is overdue — 87% believe the decisioning process should make it easier for responsible borrowers to prove their ability to repay.

Open banking could help provide that missing piece. By choosing to share their bank account data, applicants can paint a more complete picture of who they are. Real-time insights into their accounts — such as a thin credit borrower’s biweekly deposits, cash flow or consistent payments for bills like utilities — offer an up to date, more comprehensive view of their financial health.

This shift in consumer mindset opens new horizons for lenders, allowing them to champion more inclusive processes.

Digital lending is on the rise

Open banking has the potential to accommodate millions of thin-credit applicants who have previously had difficulties accessing the benefits of the financial system. Consumers have spoken. They want the next evolution of lending to prioritize transparency, accessibility and empowerment for consumers worldwide to build a more inclusive digital economy where everyone thrives.

The data revealed in Mastercard’s Lend Report shows global consumer support for a more transparent, digital-first approach to lending. Read more about the future of lending in Mastercard’s Lend Report here.