E-commerce

Build seamless checkout experiences with open banking

Turn more online shoppers into paying customers with a frictionless and fast payment flow that keeps things simple. With a convenient and cost-effective solution embedded directly in the online checkout experience, open banking payments and e-commerce are a match made in heaven.

And whether you have an open banking licence or not, we have an e-commerce solution just for you.

Features

While reducing fraud and increasing conversion rates for merchants, open banking payments offer consumers all the choice, convenience and transparency they deserve. Here’s how.

A simple but powerful setup

With us as your open banking partner, everything is possible with one API, which means there’s no need to worry about separate APIs for separate payment rails.

Just one simple API integration to connect to thousands of banks and multiple payment rails.

Multi-rail network for seamless data and payment flow

Get access to multiple payment rails, such as domestic schemes, SEPA and SEPA instant. We reduce the settlement time by a day or two, as we support access to a wide range of payment rails, which enables faster and frictionless settlements.

Automated processes for convenience and efficiency

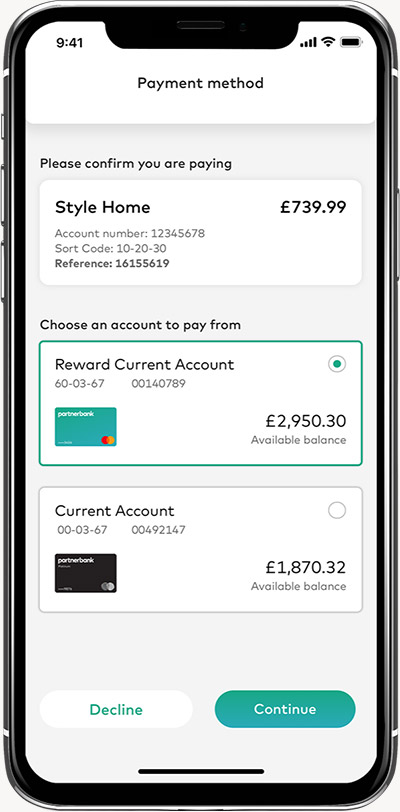

Payment information is pre-populated so the user doesn’t have to type in long numbers. This is not only easier and faster for the user, but it also reduces human error for operational efficiencies.

Branded, customised user journey

The payment flow can be customised so the customer experience looks and feels like your brand, and our solution is easily integrated into your existing platform.

Refund and reconciliation support

Our Open Banking platform provides you with the foundation to build your own powerful refund tools, thanks to our enriched data.

We provide transparency of payment activity, and you can tie references of your choice to every payment, which are automatically carried through the payment process — simplifying the reconciliation process.

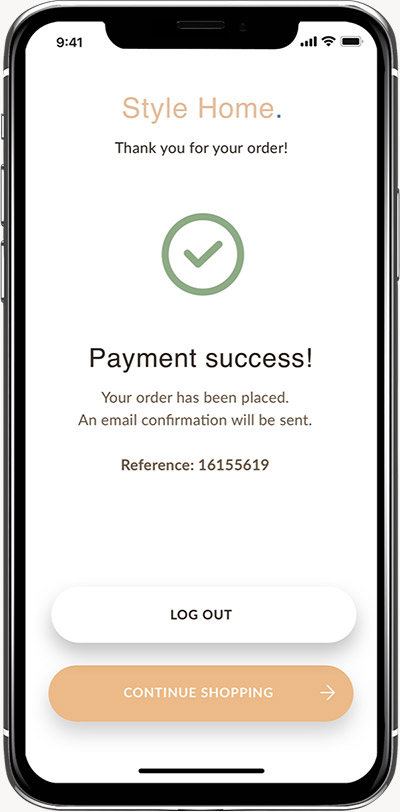

How it works

A streamlined checkout experience directly embedded into your flow

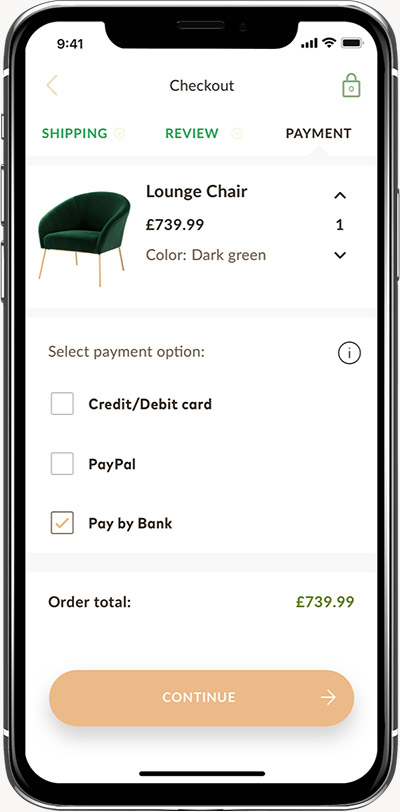

01 Merchant

Merchant integrates open banking checkout. Customer selects ‘Pay by Bank’ as payment option.

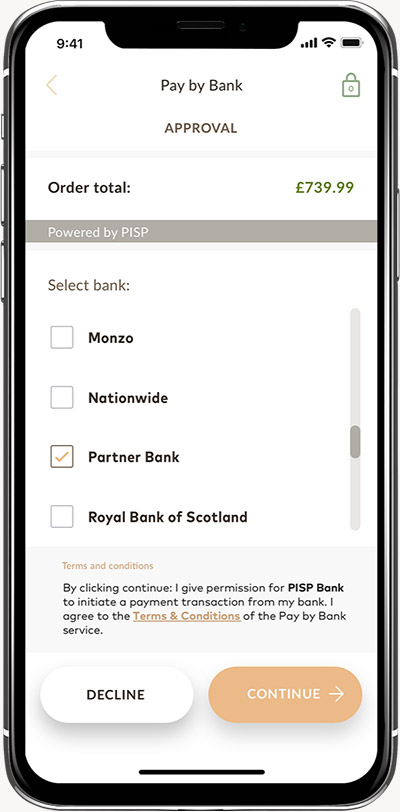

02 Merchant

Customer selects their bank and gives permission to PISP to initiate the payment. Consent ID is captured by Mastercard.

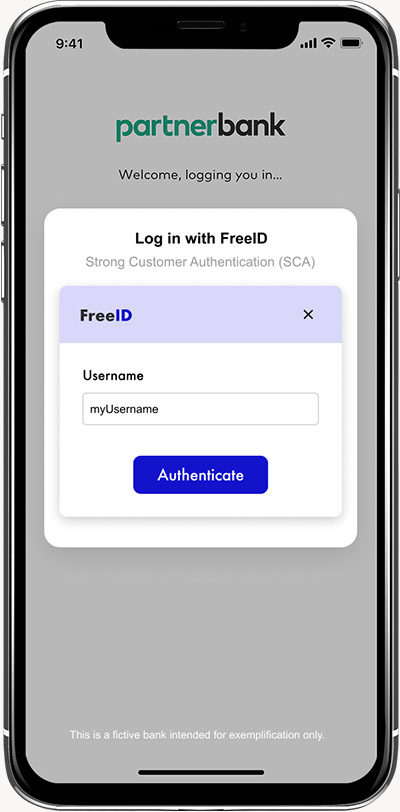

03 Bank

Customer authenticates themselves using the bank’s existing authentication method.

04 bank

Available accounts and balances are displayed, and customer selects preferred account. Amount and destination are automatically populated by open banking API.

05 Merchant

The customer is automatically redirected back to the merchant’s app and provided with a reference number.

Explore the key benefits

Boost conversion

Embedded payments create a seamless and convenient checkout experience, increasing conversion from online shopper to paying customer.

Simple, secure API integration

A robust, secure and easy-to-implement direct API for all payment rails is easily embedded into your existing platforms.

Cost-effective solution

Open banking provides a cost-effective solution at a fixed price per transaction.

Expansion opportunities

With Mastercard’s global data and payments network and bespoke consulting services, partnering with us makes it easy for you to scale your business with confidence.

Customer stories

Transforming checkout experiences with open banking

How Avarda boosted its checkout solutions with Mastercard Open Banking.

Other customers benefiting from our solution