It’s very simple: Borrowers want a better and more inclusive lending experience. Lenders want the most accurate, real-time data for credit decision-making and better risk management.

But for many decades, traditional credit assessments have been associated with long, manual processes that have left room for human mistakes. Ultimately, missing or outdated information about a borrower has excluded people with thin files from getting the credit they applied for.

With open banking, that’s all about to be a thing of the past. Our open banking data solutions give you access to the real-time insights needed to help you make informed, fair lending decisions – which can allow you to accept more loan applications and reduce the risks associated with underwriting and servicing those loans.

Let’s explore how.

The numbers tell the story

When determining whether a person or business is qualified for a loan, having access to the very latest and most accurate financial data is crucial. But obtaining that data can be a cumbersome and time-consuming process. Ultimately, that can lead to problems such as expensive credit, limited access to credit or borrowing more money than you can pay back.

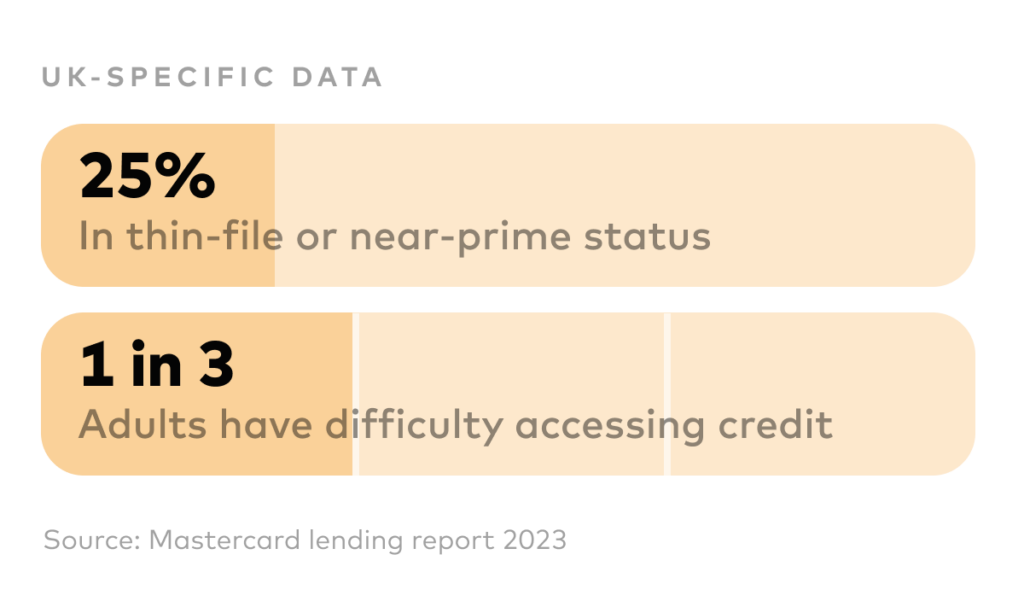

According to a global Mastercard survey, 73 percent of consumers are worried about their ability to qualify for credit in the next year. In the UK, 25 percent of adults are considered thin-file or near-prime, while 1 in 3 adults have difficulty accessing credit.

Consumers are ready for a change. The same survey revealed that 85 percent would be more likely to pursue a loan with a digital application, and 71 percent are willing to share access to their financial data to secure credit or a loan.

Open banking is changing the face of lending

That’s where open banking comes into the picture. Our open banking platform gives you the ability to opt-in to multiple services with minimal integration, and to create tailored solutions that match your consumer lending needs.

Thanks to that, it can be possible to:

- Increase conversion – through streamlining the onboarding, application and underwriting processes

- Increase security – confidently know who your customers are, that they own their linked accounts and have the required funds

- Improve operational efficiency – reduced processing time and decreased settlement, default and fraud risk

Not only does open banking data allow for automated and more frictionless processes, but it also supports fair lending decisions by increasing credit access for underserved populations.

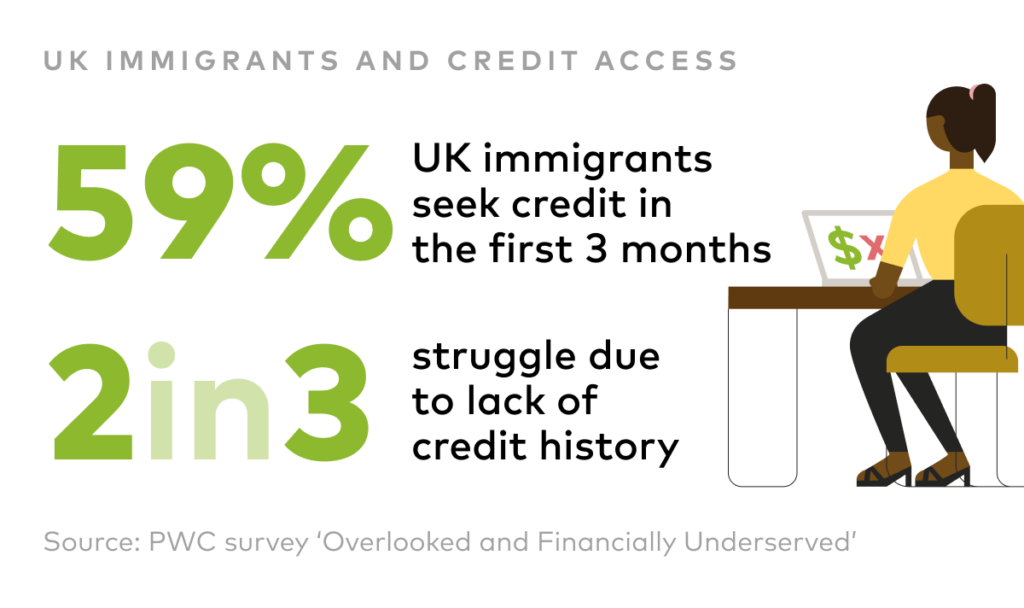

According to the PWC survey ‘Overlooked and Financially Underserved’, 59% of UK immigrants seek credit in the first 3 months. 2 in 3 struggle due to lack of credit history. But with access to real-time, accurate open banking data, it can be possible to improve financial inclusion by increasing access to funds for thin file, near prime customers, or new to country.

With modern technologies such as open banking in place, consumers are now able to safely share an accurate and up-to-date overview of their financial data, enabling lenders to make equitable and informed decisions regarding credit — which can contribute to greater financial inclusion.

Get access to the latest insights about how lenders are improving their approval process and lending experience by downloading our latest global lend report or visit our home for consumer lending in Europe. You can also deep dive into how U.S. based Nova Credit uses open banking data to create credit profiles for immigrants and new Americans.