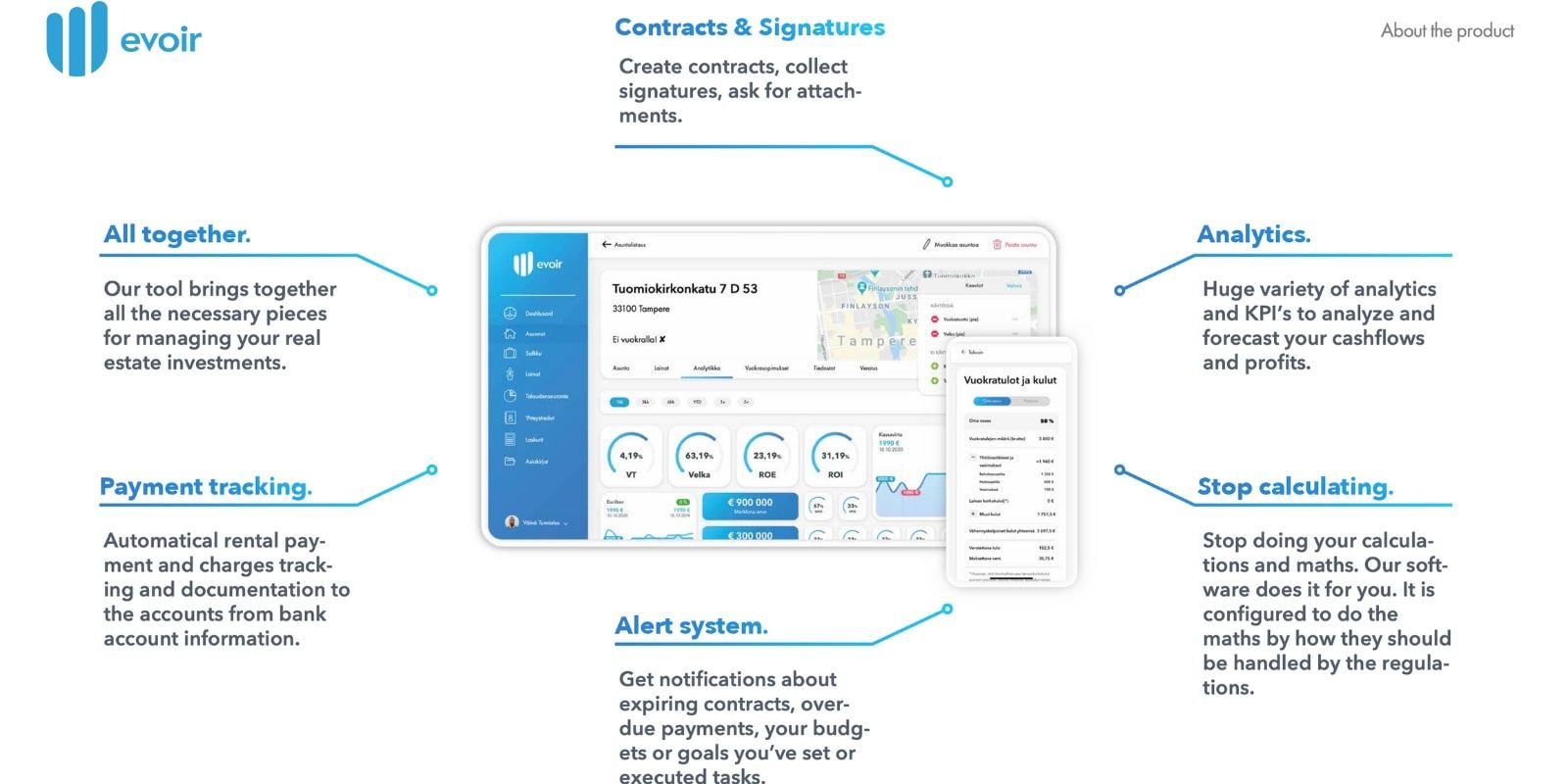

Based in Finland, Evoir is a forward-thinking platform that helps private landlords and real-estate investors save time and resources managing properties by gathering all tools and information in one place fully digitally.

Evoir recently teamed up with our fast-track open banking platform, Aiia, to enable its users to automate accounting, set up automatic rental payment tracking, analyse portfolios, create, store and sign contracts, synchronize data and much more.

We sat down with the CEO and Founder of Evoir, Pyry Palosaari, to explore how the platform pioneered open banking in the real-estate investment industry.

A one-stop shop for managing properties

With a background in maths and business development, and an inherent interest in real-estate investments, Pyry was well aware that there didn’t exist a platform that private or company real-estate investors can use to save time on managing their properties. Instead, they were using Excel sheets or other manual programmes to keep track of the properties they own. And that takes a lot of time and nerve, he says:

“Real-estate investments can be really time consuming compared to investing in stocks, as you need to take care of tasks such as creating tenant contracts, property renovations, tracking the rent and much more. But with Evoir, landlords can get a full overview of all these things in one place,” Pyry explains and continues:

“With open banking, we’ve been able to create features such as automatic rental payment tracking and automatic entries to financial statements. With that, landlords only have to do many of the tasks once, as our software looks for a transactional match which will not only tell our users that we found the match but will also create an automatic entry.”

Pioneering open banking in a new industry

When Pyry decided to develop the platform last year, he knew that the platform should be powered with financial data, even though it was still quite unexplored how property management and real estate investors could use open banking to create better services. And that’s how Evoir became a first-mover on the area:

“We wanted to offer automatic rental payment tracking from the beginning, and that’s why we were looking for an open banking partner that could deliver the bank integrations,” he says, further explaining why Evoir chose Nordic API Gateway as their open banking partner:

“When we searched the market for an open banking partner, we found that Nordic API Gateway had a good drive to push the industry forward. We also discovered that Nordic API Gateway always wants to be better at what they do, which aligns perfectly with our way of thinking,” Pyry states.

Commenting on the new opportunities of open banking, Commercial Lead at Nordic API Gateway, Benjamin Kyster, says:

“Evoir is without doubt an exciting case to follow in the open banking space. It shows how you can initiate new business ideas quickly and make a huge impact. We’re happy to empower Evoir on its journey towards making life for landlords simpler by removing the hassle of time-consuming tasks. With our platform Aiia, we’re aiming to make open banking accessible for everyone, no matter industry, size or vision.”

Within a few months, Evoir has obtained 200 customers in Finland and plans to develop more languages for the platform so it can be launched internationally in the future.