Log into Nordea Private or Nordea Business

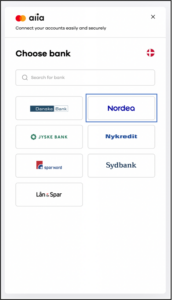

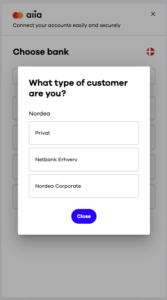

Choose “Nordea” in the bank selector. Then choose “Privat” or “Netbank Erhverv”. The country can be changed by clicking the flag in the top right corner.

Log in with MitID (Denmark), SSN (Sweden), FO (Finland). Generally, the login should work the same way it does in your online bank.

Choose the accounts you wish to integrate with Mastercard Open Banking, and press “continue”.

Now you will have a connection to Nordea.

Connecting with Nordea Corporate

Log into The Hub, and choose “Nordea” in the bank selector. Then choose “Nordea Corporate”.

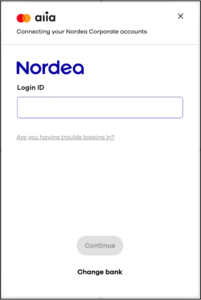

Type in your Nordea Corporate agreement number and click continue. In the next step, type in your login ID (logon ID). This is not the same number as the agreement number.

Note: the login requires two administrators of the corporate agreement to authenticate with each of their ID’s and Nordea app.

Choose the accounts you wish to add and click “continue”. Follow the connection flow. Now you will have a connection to Nordea Corporate.

For business users

Logging in to Nordea’s Swedish business solution requires a 10 digit organisation number or a 12 digit social security number (SSN), if you run a sole trader company. The ID you sign in with have to match the selections you make on Nordea’s interface.

Logging in to Nordea’s Finnish business solution requires an 8 digit FO number (no hyphen). The ID you sign in with have to match the selections you make on Nordea’s interface.

For corporate users

(This information is obtained from Nordea)

As a Nordea Corporate Netbank (CN) customer you can use the PSD2 interfaces through your service provider by having these Corporate Netbank customer prerequisites:

- A Corporate Cash Management Agreement (CCM)

- Nordea Corporate accounts in Corporate Netbank.

- One or several CN Administrators in the CM Agreement

Improvements for Corporate Customers when accessing third party services

We have simplified the access to third party providers (TPPs) for Nordea large corporate customers. This concerns all corporates who use Corporate Netbank.

Before the change, corporate customers had to appoint an Open Banking administrator to manage TPPs. With this change all existing and new Corporate Netbank (CN) administrators will be able to authorise and manage TPPs by default.

All CN administrators, both existing and newly appointed, with ‘confirm alone’ and ‘confirm together’ rights can authorise access to all company accounts via a TPP. The authorisation is required from the CN administrator before the TPP can get access to the customer accounts.

For payment initiation services, there is always the requirement for a user to confirm the payments before further processing. The ‘payment confirmation’ rights are not affected by the mentioned changes. All existing users with their existing ‘payment confirmation’ rights remain as-is in Corporate Netbank and for confirmation of payments via a TPP.

Existing Open Banking (OB) administrators prior to 5 October

The corporates that appointed an existing Open Banking administrator prior to 5 October could be affected by the change. If the Open Banking confirmation rights (alone or together) are different than the CN confirmation rights, then the CN confirmation rights will be aligned also for Open Banking.

As an example; In the case where an Open Banking administrator had ‘Confirm alone’ rights and a CN Administrator had ‘confirm two together’ rights, then the rights for authorising TPPs will be aligned to the CN rights which is ‘Confirm two together’.

Have more questions? Submit a request